Financial Planning

- Home

- Our Services

- Financial Planning

Financial Planning

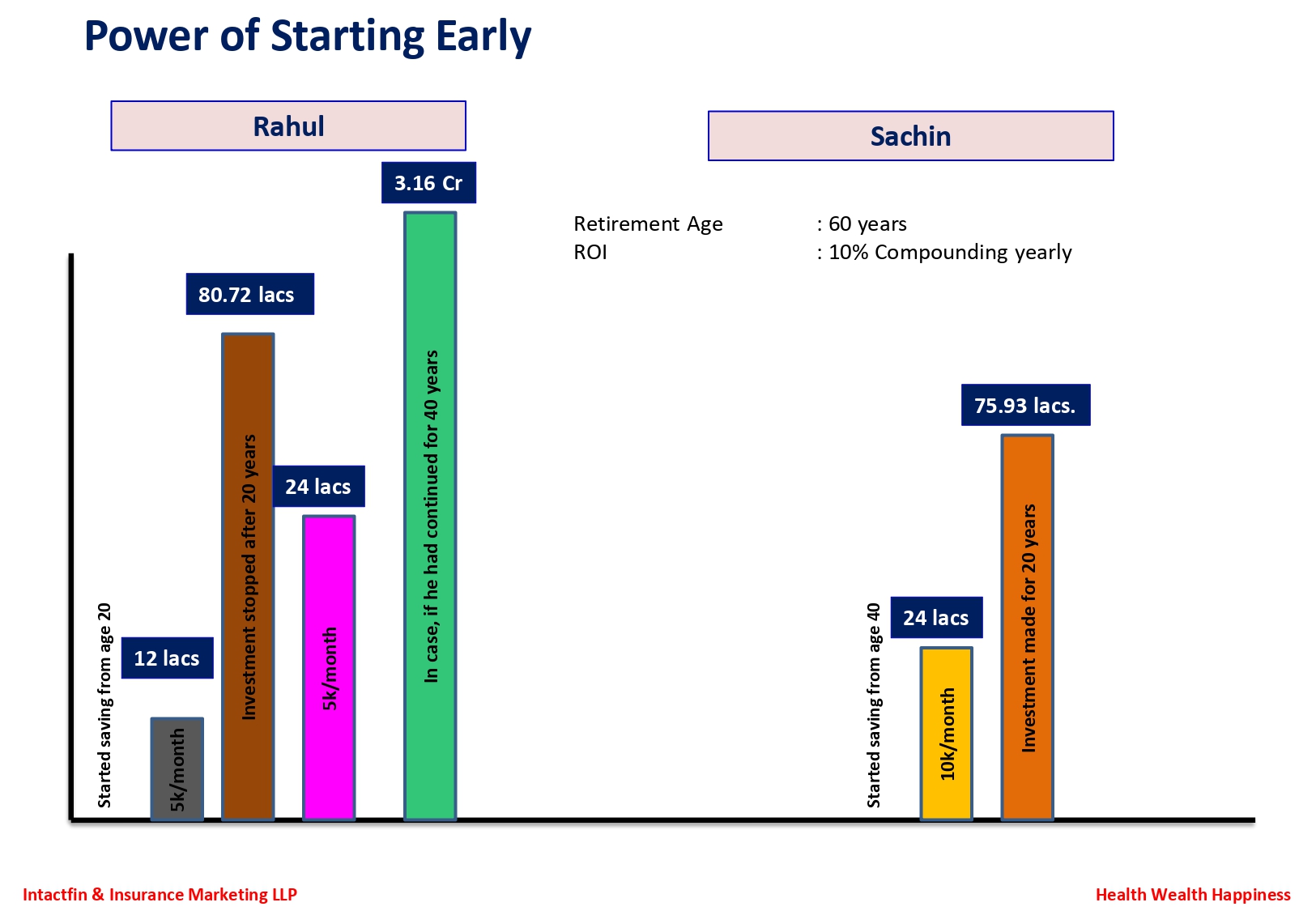

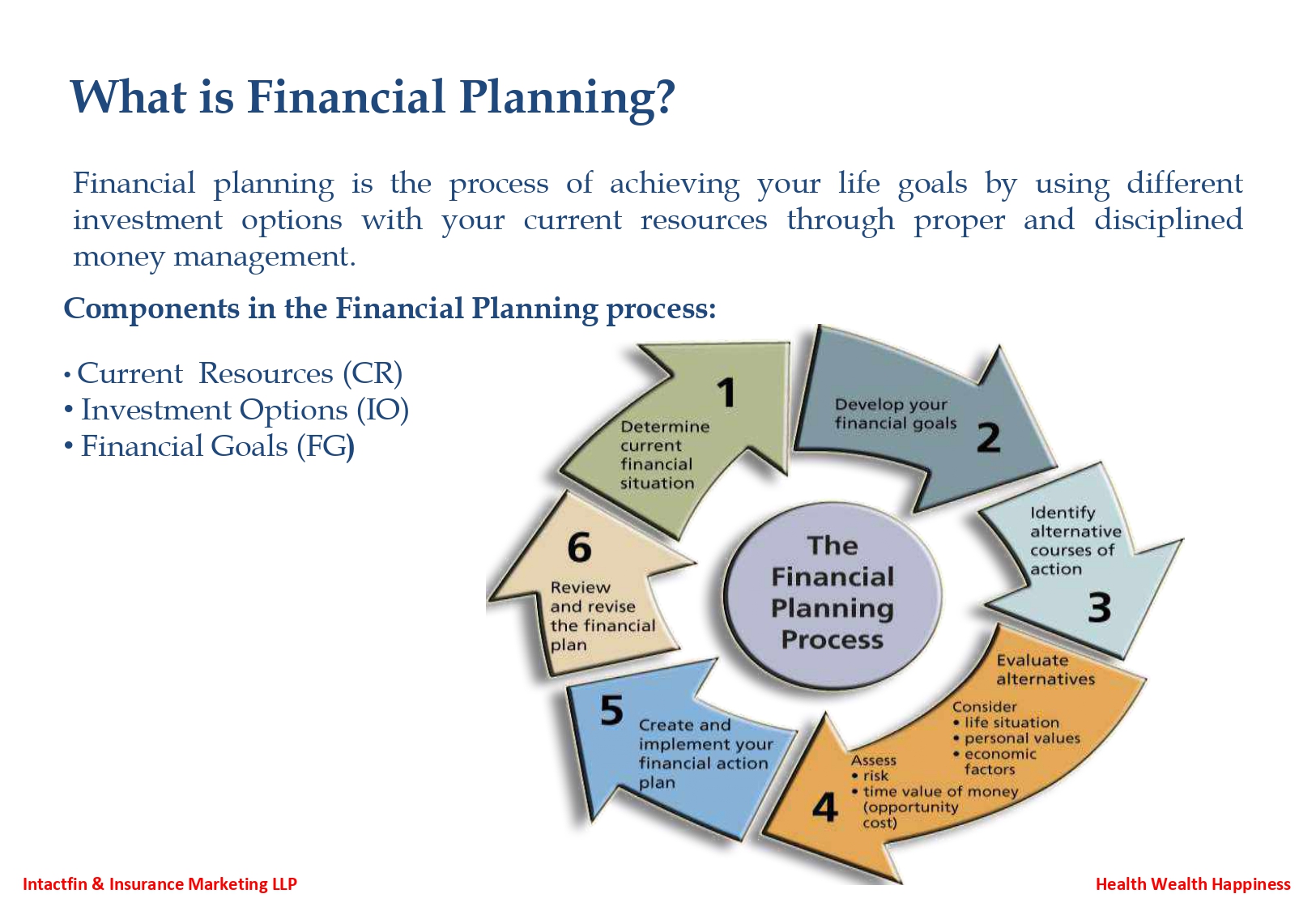

Financial planning is the process of achieving your life goals by using different investment options with your current resources through proper and disciplined money management.

Components in the Financial Planning process:

Components in the Financial Planning process:

- Current Resources (CR)

- Investment Options (IO)

- Financial Goals (FG)

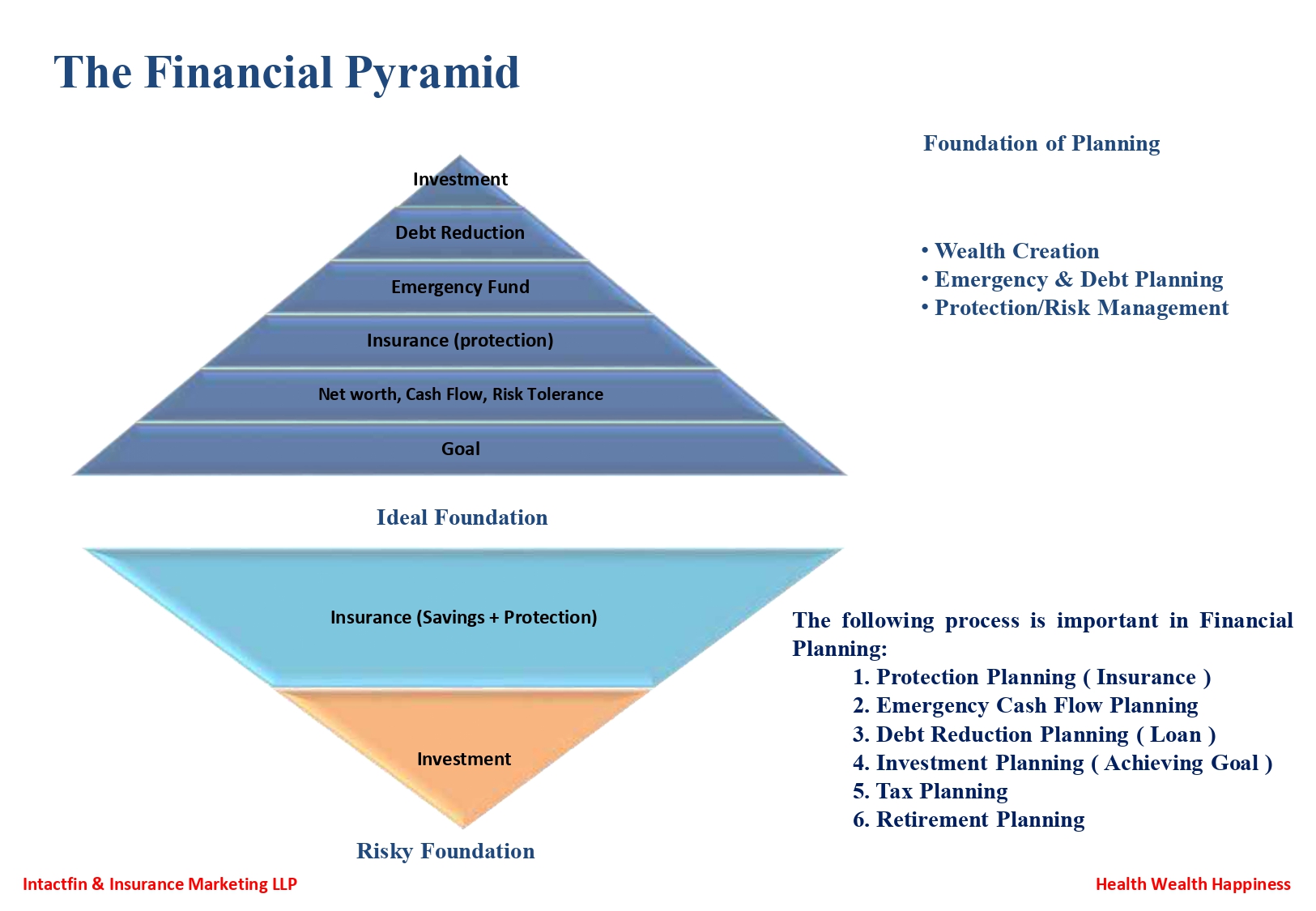

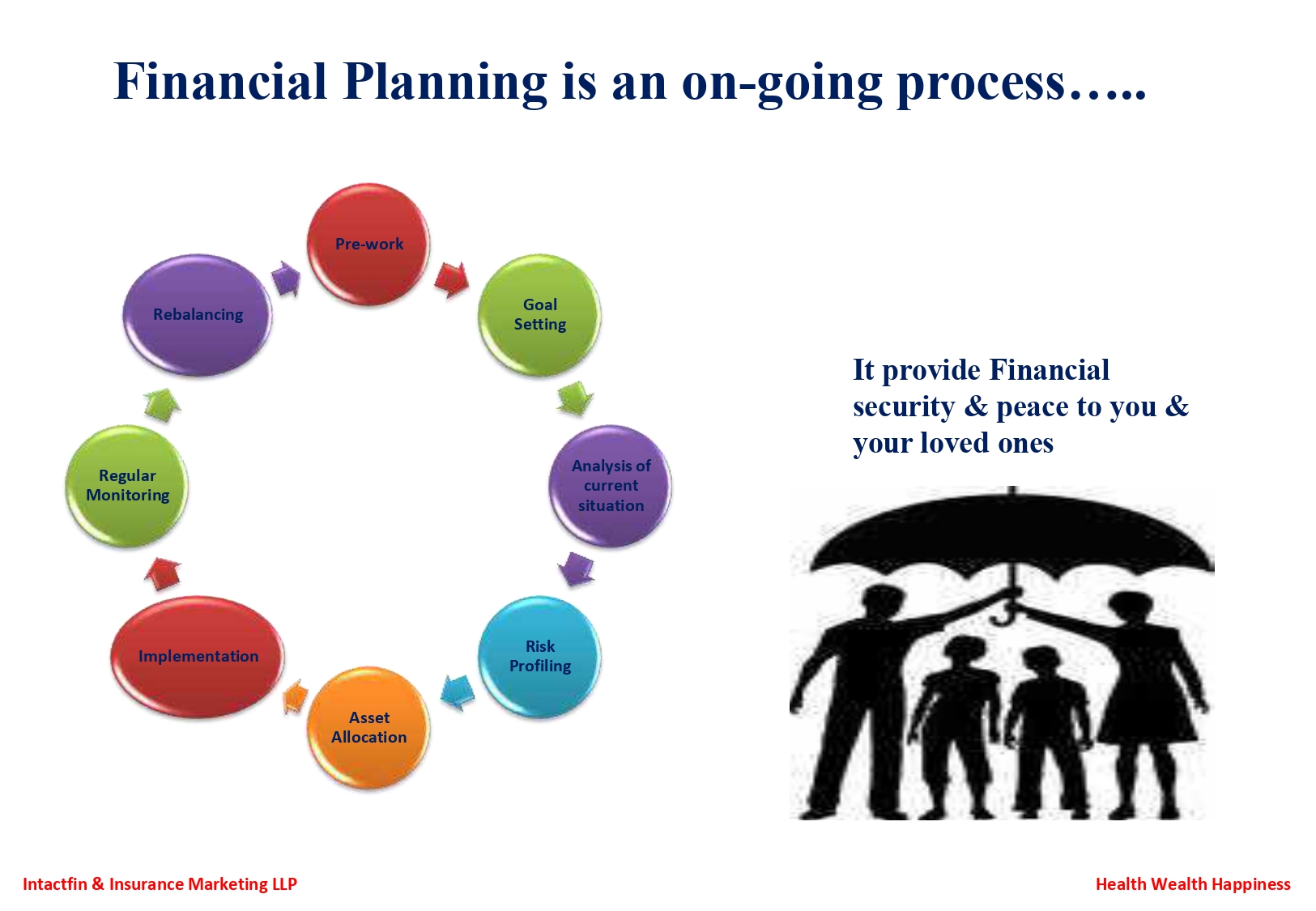

Processes of Financial Planning

- Determine current financial situations

- Develop your financial goals

- Identify alternative courses of action

- Evaluate alternatives – Consider – life situation/ personal values/ economic factors Assess – Risk/ Time value for money (opportunity cost)

A Financial Planner

A financial planner is a qualified investment professional who helps individuals and corporations meet their long-term financial objectives by analyzing the client’s status and setting up a program to help the client meet those goals.

What does a Financial Planner do?

The Financial Planner first makes a note of your financial goals and its priorities. Then the planner analyses your current financial situation, recommends the right plan with proper asset allocation, monitoring it regularly, rebalance your portfolio from time to time based on your changing life style and investment opportunities.v

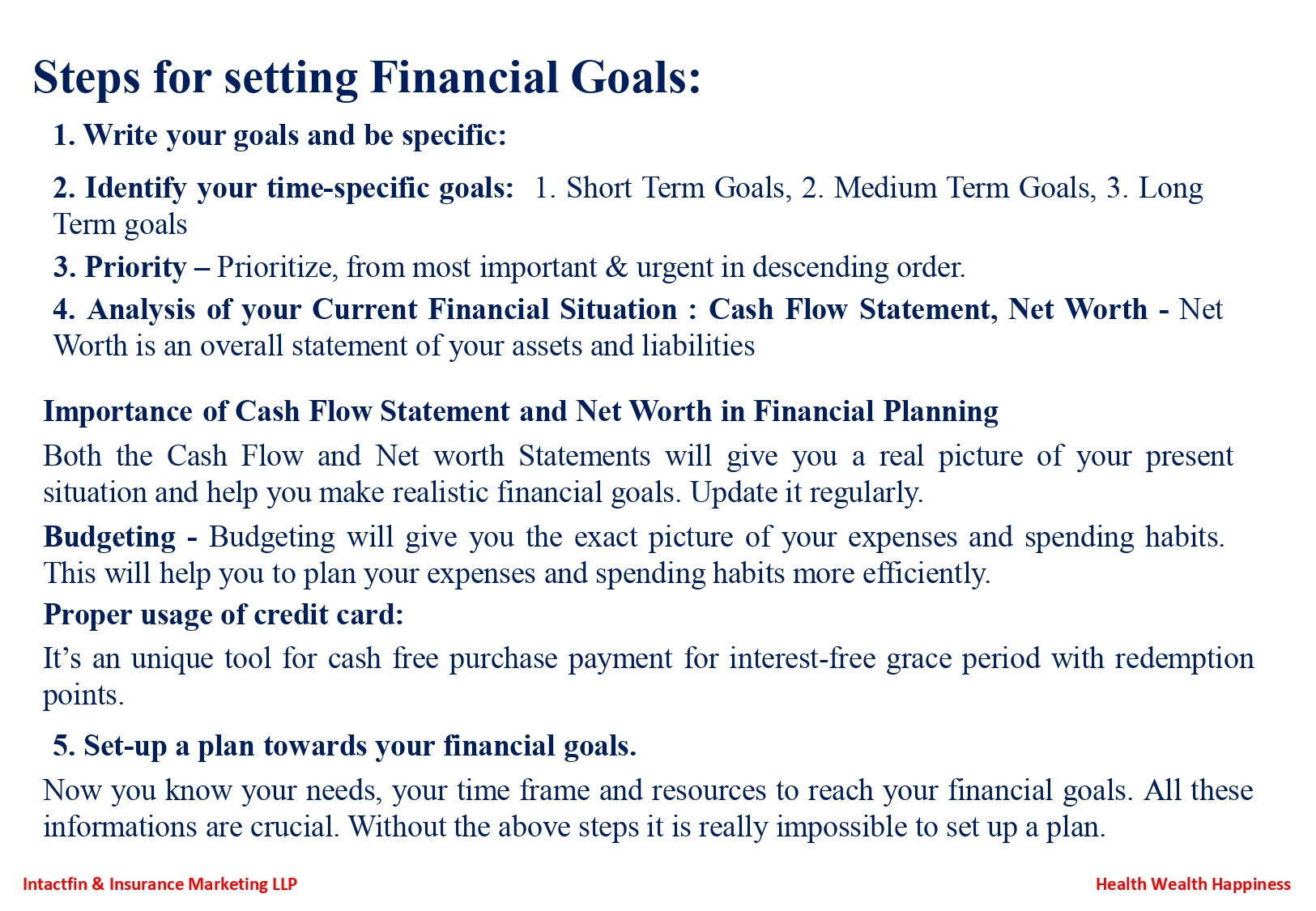

Steps for setting Financial Goals:

- Write your goals and be specific:

- Identify your time-specific goals: 1. Short Term Goals, 2. Medium Term Goals, 3. Long Term goals

- Priority – Prioritize, from most important & urgent in descending

- Analysis of your Current Financial Situation : Cash Flow Statement, Net Worth – Net Worth is an overall statement of your assets and liabilities

Importance of Cash Flow Statement and Net Worth in Financial Planning

Both the Cash Flow and Net worth Statements will give you a real picture of your present situation and help you make realistic financial goals. Update it regularly.

Budgeting – Budgeting will give you the exact picture of your expenses and spending habits. This will help you to plan your expenses and spending habits more efficiently.

Proper usage of credit card: It’s an unique tool for cash free purchase payment for interest-free grace period with redemption points.

Set-up a plan towards your financial goals.

Now you know your needs, your time frame and resources to reach your financial goals. All these informations are crucial. Without the above steps it is really impossible to set up a plan.